Retirement Planning copyright Fundamentals Explained

The 10-Minute Rule for Retirement Planning copyright

Table of ContentsIa Wealth Management Things To Know Before You Get ThisUnknown Facts About Financial Advisor Victoria BcNot known Facts About Ia Wealth ManagementIndependent Financial Advisor copyright Things To Know Before You BuySome Known Questions About Private Wealth Management copyright.Independent Financial Advisor copyright for Beginners

Heath is an advice-only planner, therefore the guy does not handle his customers’ cash right, nor does he promote them particular financial products. Heath says the selling point of this method to him would be that the guy doesn’t feel sure to provide a certain item to resolve a client’s money problems. If an advisor is only geared up to sell an insurance-based cure for difficulty, they might end steering someone down an unproductive road inside the name of striking product sales quotas, he says.“Most monetary services folks in copyright, because they’re compensated according to the items they provide market, they are able to have motivations to suggest one course of action over another,†he states.“I’ve picked this course of activity because I can appear my personal consumers to them and not feel I’m benefiting from them by any means or trying to make a sales pitch.†Story goes on below ad FCAC notes the way you pay your consultant hinges on the service they give you.

Fascination About Investment Representative

Heath with his ilk are settled on a fee-only product, consequently they’re settled like an attorney could be on a session-by-session basis or a per hour consultation rate (independent financial advisor copyright). With respect to the range of solutions together with knowledge or typical clientele of one's expert or coordinator, hourly costs can range when you look at the hundreds or thousands, Heath says

This is as high as $250,000 and above, he states, which boxes on the majority of Canadian homes from this degree of solution. Tale goes on below advertising for the people incapable of spend costs for advice-based approaches, and for those unwilling to stop a percentage of these financial investment returns or without enough cash to begin with an advisor, you will find several more affordable and also free choices to take into consideration.

The Only Guide for Investment Consultant

Tale goes on below advertising choosing the best economic coordinator is a little like online dating, Heath claims: you intend to discover somebody who’s reputable, has actually a character match and is suitable person for level of existence you are really in (https://www.bitchute.com/channel/rhnBTeLFYHxu/). Some favor their unique advisors to-be more mature with much more knowledge, he states, while others favor some body younger who is able to ideally stick with them from very early years through retirement

Excitement About Tax Planning copyright

One of the greatest errors somebody make in choosing a consultant just isn't asking adequate questions, Heath states. He’s surprised when he hears from clients that they’re nervous about asking questions and probably appearing foolish a trend he locates is as common with developed professionals and the elderly.“I’m amazed, as it’s their cash and they’re having to pay plenty charges to the people,†he says.“You need for your questions answered and you also deserve getting an open and truthful relationship.†6:11 economic planning all Heath’s final guidance is applicable whether you’re trying to find outside monetary help imp source or you’re going it alone: keep yourself well-informed.

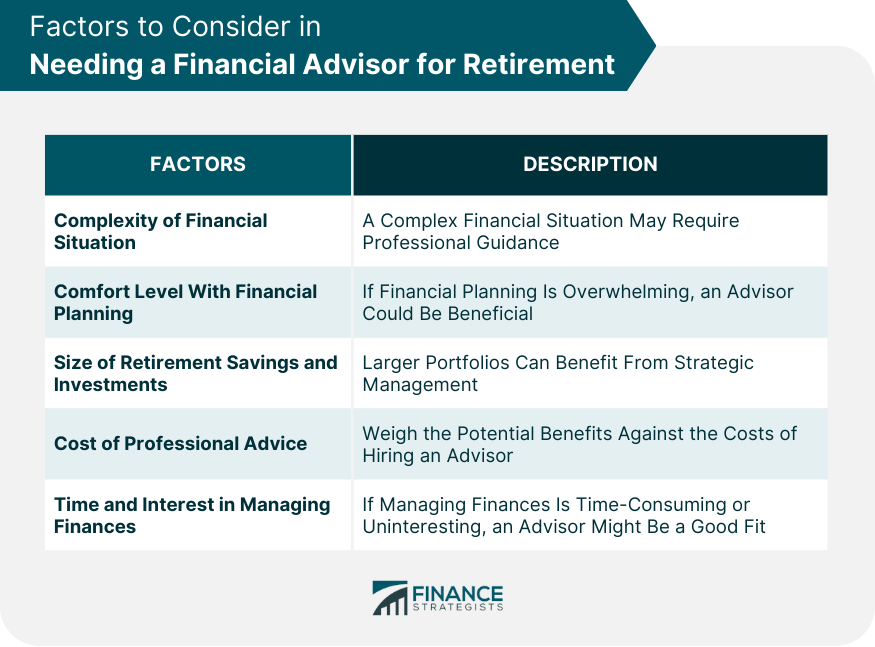

Here are four facts to consider and ask your self whenever determining whether you should tap the knowledge of a financial advisor. Your own web worth isn't your revenue, but rather an amount that will help you realize just what money you get, how much cash it can save you, and in which you spend some money, as well.

Not known Facts About Retirement Planning copyright

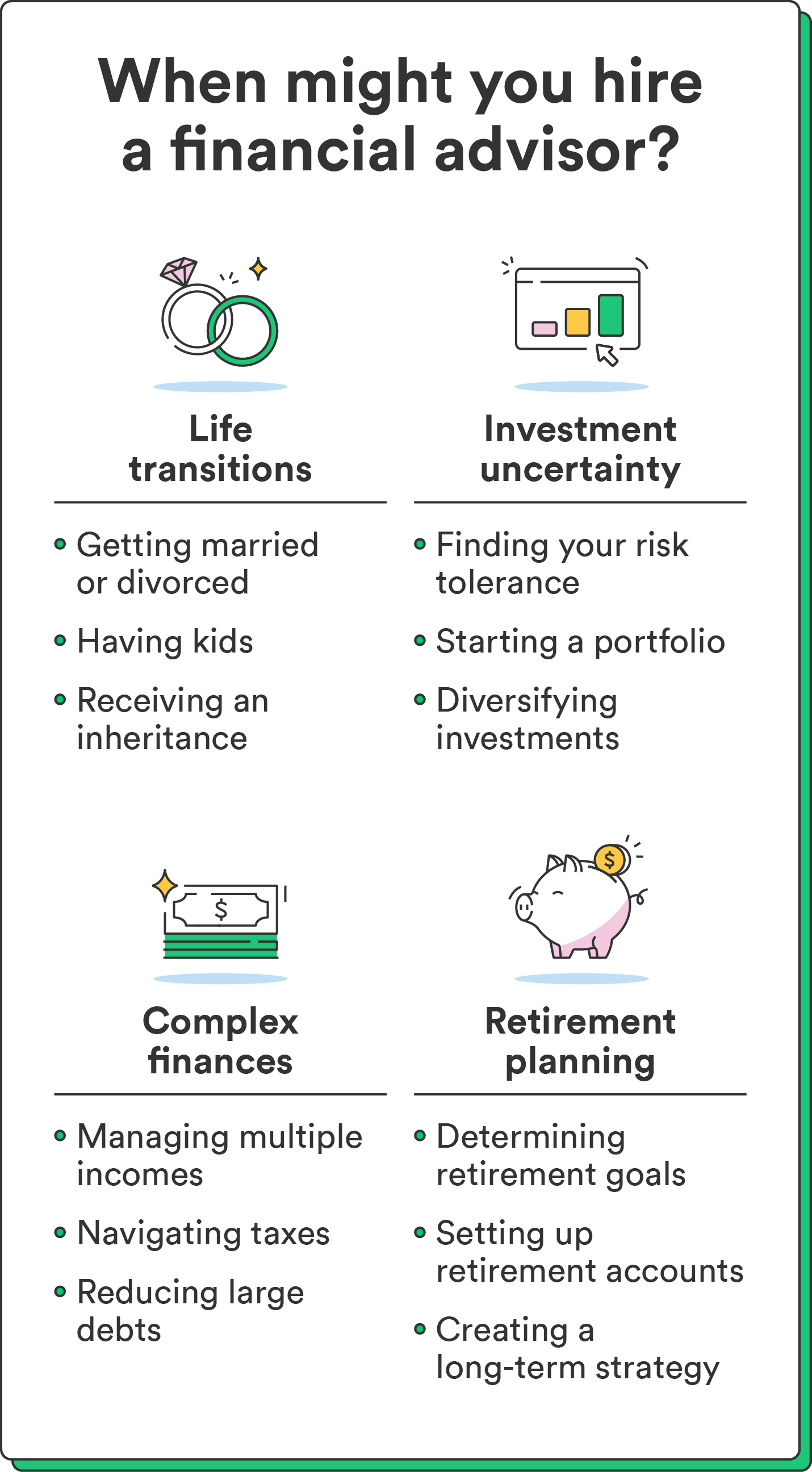

Your child is on ways. Your divorce proceedings is pending. You’re approaching retirement. These along with other significant existence events may prompt the need to go to with a monetary expert about your assets, your financial goals, alongside monetary things. Let’s state your own mom remaining you a tidy sum of money within her will.

You could have sketched out your very own financial program, but I have difficulty sticking with it. An economic expert can offer the responsibility you need to place your economic intend on track. They even may advise simple tips to modify your own economic program - https://www.blogtalkradio.com/lighthousewm being maximize the potential results

Independent Investment Advisor copyright - The Facts

Anyone can state they’re a financial advisor, but an advisor with pro designations is if at all possible the one you need to hire. In 2021, an estimated 330,300 Americans worked as personal economic experts, according to the U.S. Bureau of work studies (BLS). Many monetary analysts tend to be freelance, the bureau says - financial advisor victoria bc. Normally, discover five forms of financial analysts

Agents usually earn profits on investments they make. Brokers tend to be controlled from the U.S. Securities and Exchange Commission (SEC), the economic field Regulatory Authority (FINRA) and condition securities regulators. A registered expense expert, either you or a strong, is a lot like a registered representative. Both buy and sell investments with respect to their customers.